is pre k tax deductible

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. A credit called the Child and Dependent Care Credit worth up to 1050 for one child and up to 2100 for two or more kids.

Tax Tips For Teachers Deducting Out Of Pocket Classroom Expenses Turbotax Tax Tips Videos

Discover Helpful Information And Resources On Taxes From AARP.

. Children are required to go to school at age five for kindergarten. Nursery school and other prekindergarten costs generally qualify for the Child and Dependent Care Credit because the educational benefits are considered incidental to the child care costs. Tax credits also directly reduce your tax bill.

That doesnt necessarily mean you cant still get some money back in your pocket. Is Private School Tuition Tax Deductible. A credit called the Child and Dependent Care.

Is there tax relief for preschool parents. A deductible expense is the one you can subtract from your income to reduce your tax liability. Tuition for kindergarten and up is not an eligible expense but if you pay extra for before or after school care so that you and your spouse could work those.

The care provider cant be your spouse the parent of your child someone you or your spouse could claim as a dependent on your tax returns or another one o See more. A credit called the Child and Dependent Care Credit worth up to 1050 for one child and up to 2100 for two or more kids. Additionally you might consider education-focused investment options such as a Coverdell Education Savings.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. The IRS does not offer tax breaks for the education expenses incurred for students in kindergarten through high. Preschool fees are generally not tax-deductible from a parents taxes.

A credit called the Child and Dependent Care Credit worth up to 1050 for one child and up to 2100 for two or more kids. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. Expenses under kindergarten preschool tuition day care etc are always eligible even if the program is educational.

A credit called the Child and Dependent Care Credit worth up to 1050 for one child and up to 2100 for two or more kids. August 20 2021 by Steve Banner EA MBA. By Katherine Hutt Scott.

Although preschool expenses do not qualify as a tax. If you have received childcare compensation from your employer you should deduct that from your total expenses in computing the credit as directed by Form 2441. And thanks to recent changes in the tax law the benefits for preschool tuition paid during the 2021 tax year are.

Tuition is not deductible on federal income taxes but parents have other options to reduce costs. The bottom line here is that kindergarten isnt tax deductible. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction.

Im pleased to say that under certain circumstances you can indeed claim a tax benefit for preschool tuition. Best States for Pre-K. Kindergarten costs are generally not eligible for any tax credits or deductions.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. Table of Contents show. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction.

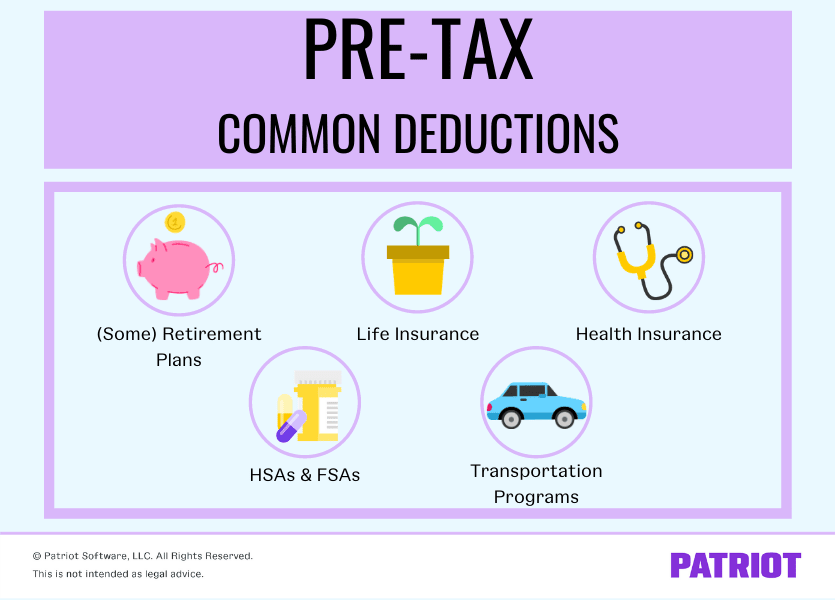

The credit is limited to a maximum of 3000 per child and 6000 for two or more children in. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. Small business tax prep File yourself or with a small business certified tax.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Additionally you might consider education-focused investment options such as a Coverdell Education Savings Account. When an employee pays for benefits such as health insurance with before-tax payments the.

First and foremost you should know that preschool tuition isnt technically tax deductible.

Nature Preschools Preschool Programs

What Are Payroll Deductions Article

St Patrick Montessori Preschool Facebook

Tax Tips When Sending Kids To Private Or Public Schools Turbotax Tax Tips Videos

Pre Tax Vs Post Tax Deductions What Employers Should Know

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

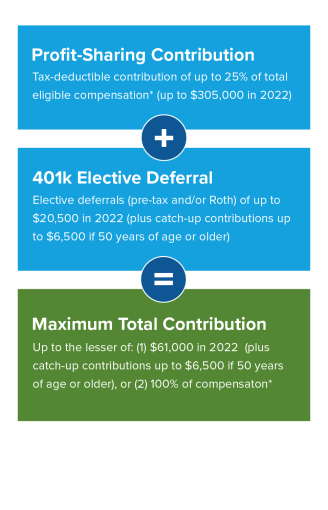

The Individual 401 K Select Portfolio Management Inc

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Is A 401 K Match Contribution Tax Deductible Human Interest

Different Types Of Payroll Deductions Gusto

What Are Pre Tax Deductions Definition List Example

Can I Claim Private Pre K As A Tax Deduction

Are 403 B Contributions Tax Deductible Turbotax Tax Tips Videos

Is Preschool Tuition Tax Deductible Sapling

Rantoul City Schools Sd 137 Homepage

Teachers Deserve More Than The Current Paltry Tax Deduction For Classroom Costs Don T Mess With Taxes

How To Get A Tax Deduction For Supporting Your Child S School